The success any agency can get for a client depends on WHO that client is and WHAT industry they’re in.

Generative Engine Optimization (GEO) for a local business is very different from GEO for an e-commerce brand, and neither of those looks anything like GEO for a SaaS company.

Even between SaaS, there are nuances – a $200M ARR enterprise SaaS with a marketing department needs a different set-up than a $1M founder-led startup still building its pipeline.

So when we went looking for the “best GEO agencies,” we saw plenty of impressive names… but almost none of them were saying who they were BEST for – the reason why we created THIS list. It’s a vetted roundup of agencies, matched to specific use cases, built on an evaluation framework from the perspective of a GEO agency that’s deep in this work every day.

TLDR

- Most agencies treat GEO as an add-on, not a core focus. They do strong SEO and marketing work, but GEO is often a “me too” service with few proven wins.

- Evaluation criteria used: focus (B2B SaaS fit), technical depth, editorial quality, proof of results, and overall fit for SaaS companies.

- Top GEO Agencies identified:

- Singularity Digital (us): only agency with SaaS-specific GEO strategies, public wins, and a founder-led team that understands the $1–5M scaling stage.

- eSEOspace: Full-service agency that’s built GEO into its core stack, pairing AI-ready design and SEO depth – solid structure, though still light on public GEO case studies

- iPullRank: technically strong with big enterprise clients, but anonymized case studies and a lack of SaaS focus make it a tougher fit.

- GenerateMore.AI: Editorially strong and deeply AI-driven, combining interview-led content and agentic workflows. Great for mid-market SaaS and tech brands, though GEO proof is mostly claimed, not publicly shown.

- Intero Digital: offers dozens of services and solid tech like GRO/Search Scout, but no clear GEO success stories, and not SaaS-specific.

- Spiro: impressive wins for local businesses and e-commerce, but their GEO “process” looks identical to SEO tactics, not yet differentiated for SaaS.

- WebFX: giant agency with flashy tools, but GEO feels like an afterthought; too many layers between client and strategist for a small, fast-moving SaaS.

- GoFish Digital: well-structured GEO approach with their Barracuda platform, but no GEO-specific case studies and a diluted industry focus.

- MVP: mvpGrow: Strong SaaS marketing fundamentals and full-service growth ops, with deeper experience in traditional strategies and a growing focus on AI-led visibility.

- Dejan.ai: leans into machine learning and NLP with proprietary models, but no public case studies, promising tech, but unproven in SaaS.

What is Generative Engine Optimization (GEO)?

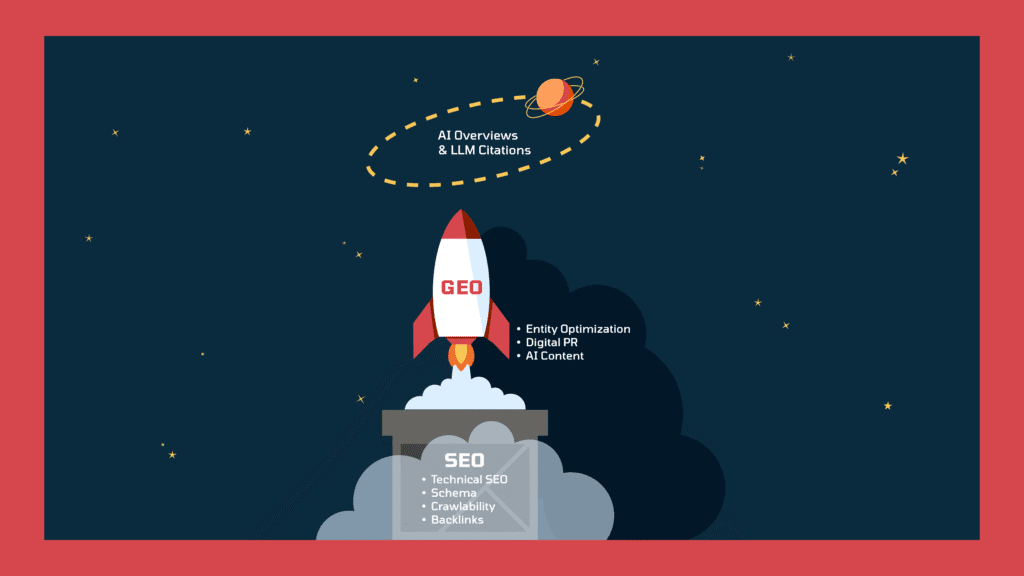

Generative Engine Optimization (GEO) is the work you do to earn a place in AI-powered answers – whether that’s Google’s AI Overviews, ChatGPT responses, Perplexity summaries, or other large language model outputs.

The strategies for GEO are built on SEO foundations but with layers for how AI systems read, trust, and cite information. That means:

- Entity optimization: making sure your brand, products, and key topics are clearly defined and consistently described across the web.

- Citation engineering: earning authoritative, context-rich mentions and links that LLMs can use to verify your claims.

- Schema and structured data: giving machines clear, machine-readable context for who you are and what you offer.

- AI-friendly content: depth-driven, expertise/data-led assets that answer questions completely and in context.

- Technical foundations: Clean site architecture, nothing important hidden behind JavaScript, etc.

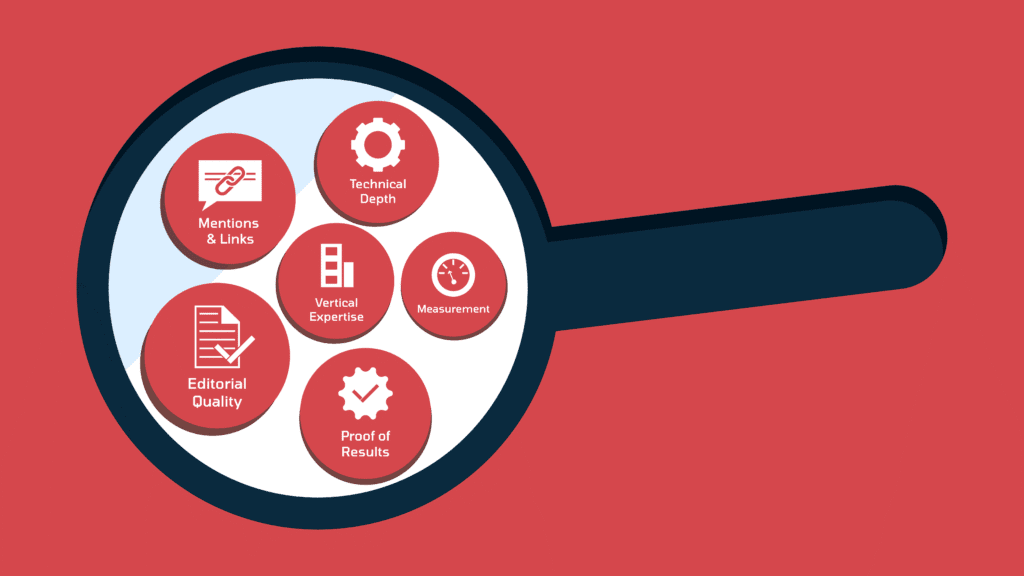

How We Evaluated The Top GEO Agencies

This all started with one goal: finding GEO partners who can actually deliver for B2B SaaS. GEO is new, and right now, almost every agency has a shiny GEO service page promising GEO-specific workflows and strategies. But once you look closely, a lot of that “GEO work” turns out to be the same SEO they’ve always done, just rebranded.

Fair point – there’s definitely overlap. Good SEO is foundational, and no GEO program is going to work without it. But taking what you already do for SEO and simply calling it GEO isn’t the same thing as building strategies designed for AI-driven discovery. So that was the line we drew.

From there, we went deep into GEO-specific factors, the technical work, the content, the authority signals, the measurement, all to make sure the agencies on this list are actually delivering GEO results.

Technical Depth

For technical depth, we looked at whether an agency had:

- A clear, articulated understanding of GEO on their service pages, not just SEO with GEO slapped in the headline.

- A defined approach to GEO that goes beyond vague promises and explains specific processes.

- GEO-specific success in the form of case studies or examples that showed how their GEO strategies in action.

- Evidence of GEO-specific audits, especially for LLM crawling differences.

- The ability to handle complex technical challenges relevant to AI search, like improving crawlability on JavaScript-heavy sites.

- Transparency in the tools and methodologies they use to measure AI-search-related visibility.

Editorial Quality

We believe that if you’re promising a content strategy that will make your clients win, you should be doing the same for yourself. So when we looked at “editorial quality,” we started with the agency’s own site, are they publishing content that shows expertise, depth, and clarity, or is it the same surface-level copy anyone can spin up with an AI tool?

Then we looked at the client side:

- Checked the websites of the clients they highlight in GEO or SEO case studies.

- Compared the content they produced to the promises they made. Like, if they claim to build authority-rich, AI-friendly, expertise-led assets, does the live content actually reflect that?

Citation Engineering

Traditional link building is still relevant, but for GEO, the type of link and the context around it matters more. So when we evaluated agencies here, we looked at whether they’re still leaning on traditional link building ALONE or if they’ve evolved into digital PR and strategic mention-building.

We paid attention to:

- Are they earning context-rich mentions in authoritative sources that both Google and LLMs can use to verify what a brand claims about itself?

- Do they have processes for securing unlinked mentions that still carry semantic weight and topical relevance?

- Are they thinking about how LLMs cross-check facts and fill in gaps when deciding whether to cite or trust a source?

Measurement & Tooling

This one’s tricky because, honestly, there’s no universal scoreboard for GEO yet. There’s no “if you hit these five numbers, you’ve nailed LLM visibility” checklist – we’re all still figuring that part out.

That said, there are signs you can look for. So we checked to see how agencies say they measure their GEO success. Are they actually tracking AI visibility in some way?

To know this, we looked closely at if they:

- Understand that while mid-funnel tracking is still a gap for GEO, the right TOFU and BOFU metrics can still tell you a lot about whether you’re actually moving the needle.

- Use tools or methods that make sense for tracking both top-of-funnel (TOFU) and bottom-of-funnel (BOFU) KPIs.

- Are keeping up with the new tools popping up specifically for AI search tracking.

Vertical Expertise

Looking at vertical expertise, we wanted to see if they’d done it for businesses like yours – B2B SaaS – and if they had proof that went beyond a logo slide.

Because the thing is, you can Google “top GEO agencies” right now and find a dozen roundups with impressive-sounding companies. A lot of them are legitimately great at what they do. But if their wins are all in e-commerce, local businesses, or Fortune 500 enterprise accounts, that doesn’t automatically translate to a SaaS company.

B2B SaaS comes with its own quirks – there are long sales cycles, complex products, niche audiences, layered decision-making. If an agency hasn’t proven they can work within those constraints, with a case study that shows how they navigated it, then all the technical chops in the world don’t guarantee they can make GEO work for your setup. That’s why this one was non-negotiable for us.

Proof of Results

This part got interesting pretty quickly. We started with a list of about 15 agencies and thought, “Alright, let’s see the case studies.” And sure enough, almost every site had a “Case Studies” link in the menu.

But when we dug in, a pattern started showing up:

-> A lot of those “case studies” were anonymized.

-> When you click through hoping for details, you get… nothing specific. No company name, no context, no real story of how they got there.

It’s flashy and exciting until you realize there’s no way to verify any of it. And if an agency can’t (or won’t) share the details of the work they’re holding up as proof, that’s a red flag.

Then there were the other kind of agencies, the ones who laid it all out:

- Who the client was.

- What challenges they faced.

- Step-by-step what was done to fix it.

- The exact results.

- Even embedded video testimonials from the client themselves.

That level of transparency is rare, but when you find it, it’s a lot easier to trust what you’re reading.

The Best GEO teams

Not all agencies are the same. We’ve found the ones who really understand SaaS and can help you get your content seen without all the guesswork.

The Top 7 GEO Marketing Agencies in 2025

| Agency | Best For | B2B SaaS Focus | Technical Depth | Editorial Quality | Public Case Studies | Starting Price Range | Key Differentiator |

|---|---|---|---|---|---|---|---|

| Singularity Digital | $1-10M ARR SaaS | ⭐⭐⭐⭐⭐ | Strong GEO-specific strategies, LLM-readable structures | Proven content ecosystems (192 AI citations for CareerFlow) | ✅ Named clients with transparent results | ~$2k-5k/month | Only agency with SaaS-specific GEO strategies and public wins; founder-led |

| iPullRank | Enterprise Fortune 500 | ⭐⭐ | Very strong – embeddings, passage retrieval, query fan-out | Strong thought leadership frameworks | ❎Anonymized ($2.4B bank, $290M eCommerce) | Enterprise pricing | Technical depth and early GEO research leader |

| GenerateMore.AI | $1-20M ARR European B2B/Tech | ⭐⭐⭐⭐ | Editorial-focused, less technical infrastructure | Very strong – interview-led, agentic AI workflows | ⚠️ SEO proven; GEO claims (40% demo increase) not yet published | Mid-market | Content-first approach with founder interviews and AI-assisted creation |

| Intero Digital | Large enterprises | ⭐⭐ | Proprietary crawler (InteroBOT®) and GRO platform | Entity-based content strategy | ⚠️ Major wins ($22M revenue growth) not tied to GEO | Enterprise pricing | Full-service with proprietary tools; one-stop shop |

| Webspero | Local & e-commerce | ⭐ | No clear GEO differentiation from SEO | Strong for local/e-commerce | ⚠️ Good numbers but standard SEO approach | Varies | Full-service development + marketing |

| WebFX | Large enterprises | ⭐⭐ | OmniSEO and Revenue Cloud FX platforms | Strong editorial output | ⚠️ Thin GEO-specific proof | Enterprise pricing | Massive scale with proprietary technology stack |

| Go Fish Digital | Cross-industry enterprises | ⭐⭐ | Barracuda AI content evaluation platform | Clear structured GEO process | ⚠️ Strong SEO (HP, Mediclo) but no GEO wins | Enterprise pricing | Structured GEO methodology with custom evaluation tool |

| mvpGrow | Early B2B SaaS startups | ⭐⭐⭐⭐ | Technical SEO foundation, pragmatic GEO tactics | Execution-focused frameworks and guides | ⚠️ AI Overview mentions claimed but no detailed case studies | Varies | Full-stack growth partner (SEO, content, HubSpot, SDR) |

| Dejan.ai | Medium-large e-commerce | ⭐ | Proprietary ML/NLP models, algorithm-driven | Data-driven but limited public content | ❎ Big clients (Zendesk, Nickelodeon) but no case studies | Unknown | AI-first methodology with custom frameworks |

Legend

- ⭐⭐⭐⭐⭐ = Excellent fit for B2B SaaS

- ⭐⭐⭐⭐ = Good fit for B2B SaaS

- ⭐⭐ = Limited SaaS focus

- ⭐ = Minimal/unclear SaaS focus

- ✅ = Public, transparent case studies

- ⚠️ = Limited or anonymized case studies

- ❎ = No public case studies

1. Singularity Digital

- B2B SaaS focus: Specializes in small-to-medium SaaS teams in the $1–10M ARR range.

- Technical Depth: Strategies include tested GEO tactics like ensuring LLM-readable site structures and driving contextual relevance through digital PR.

- Editorial quality: Builds content ecosystems that perform in both Google and AI search. CareerFlow, for example, earned 192 AI overview citations, 1000+ monthly subscribers from ChatGPT, and 27k+ new visitors from funnel-wide content mapping.

- Founder-led & agile: Clients work directly with founders who bring a decade of SEO and marketing experience, with a tight focus on five core services (SEO, GEO, PPC, content marketing, link building).

- Proof of results: Public case studies with named clients and clear results, avoiding anonymized or vague performance claims.

- Fit: Best for B2B SaaS companies looking for an agile team to help them scale fast.

Singularity takes a different stance than many of the larger, multi-service agencies.

The team is deliberately small and founder-led, which keeps them fast-moving and directly involved in client work rather than passing decisions down layers of PMs. Plus, their narrow focus on just five core services – SEO, GEO, PPC, content marketing, and link building shows that nothing gets diluted.

Another standout factor is that Singularity doesn’t treat GEO as just an add-on (unlike many others). They’re deep into this – testing and experimenting with different GEO-specific strategies in live SaaS environments. Proof of which can be found on their site in the form of informational blogs, how-to guides, case studies, etc.

The results are public and specific: They’ve shared a very recent GEO win (Careerflow.ai’s case study) showing what ROI their strategies yield. They grew that company’s AI visibility exponentially, with 192 mentions in Google AI overviews, 1k+ monthly subscribers coming from ChatGPT every month!

Retention is another marker of their approach – most clients stay for two years or more without any long-term contracts holding them (since they operate on monthly retainers). That reflects both results and trust built through direct founder-to-founder collaboration.

Singularity emphasizes this a lot – they’re not trying to chase Fortune 500 clients and are very narrowly focused on helping B2B SaaS companies in the $1–5M ARR stage push well past the $10M mark, with strategies built for their specific growth curve. And that, above all, makes it a very good potential GEO partner for SaaS.

2. eSEOspace

- Focus: ESEO Space is a full-service digital agency covering it all from design, development, SEO, and GEO. They’re broader than most GEO-specific firms, but what stands out is that they’ve actually taken the time to define what GEO means for them.

- Technical depth: Dedicated GEO hub breaks down AI SEO, Answer Engine Optimization, and how design and structure influence AI visibility. They talk openly about entity work, schema markup, and even AI training-data optimization, which is proof that they understand how modern search really works.

- Editorial quality: Their site content is refreshingly clear and educational. You can tell they’ve written it to inform, and not just rank.

- Proof of results: They have an “Our Work” section showing design and web projects, but detailed SEO/GEO case studies are still missing. The only example they share is helping a therapy-practice platform start appearing in AI-generated recommendations – it’s impressive, but light on the how-to.

- Fit: A good match for mid-size or enterprise brands that want everything, from GEO-ready site builds to ongoing marketing, under one roof.

ESEO Space is one of the few agencies actually putting in the work to define and document their GEO approach. The only trade-off is breadth. Because they span design, development, and marketing, SaaS teams looking for laser-specific GEO depth ( both technical and editorial) might find them less specialized (unless they document their GEO wins more openly and clearly).

But for businesses that want everything from website builds to AI visibility handled under one roof, they can make a good choice.

3. iPullRank

- Enterprise focus: Built for Fortune 500-scale brands across finance, eCommerce, and automotive, not $1–5M B2B SaaS.

- Technical depth: Known for championing understanding of GEO concepts like query fan-out, passage retrieval, and embeddings.

- Editorial quality: Strong thought leadership and frameworks, but case studies lack named SaaS wins.

- Proof of results: Case studies cite big revenue lifts ($2.4B for a bank, $290M for an eCommerce marketplace) but are anonymized.

- Fit: Best aligned with enterprise brands that need large-scale GEO/SEO programs, not early-stage SaaS.

iPullRank brings a lot of credibility in technical SEO and early GEO research. Their team talks in detail about the mechanics of AI search, like embeddings and relevance engineering, and they’ve published some of the most technical resources in the space.

For Fortune 500s with complex content libraries and deep budgets, that positioning makes perfect sense.

But for smaller SaaS companies in the $1–5M ARR range, the fit is less clear.

Also, one of the main things we noticed was that their case studies are impressive in scale, but they’re all anonymized, which makes it hard to separate proven client results from marketing claims. And even where they show impact, it’s tied to enterprise brands in industries far removed from SaaS.

So bottom line: iPullRank clearly knows their stuff, but their scale, client base, and opaque proof points make them less practical for B2B SaaS teams trying to grow fast and transparently at the $1–5M stage.

4. GenerateMore

- Focus: Works mainly with European B2B, tech, and enterprise companies in the $1-20M ARR range. Their clients range from scaling startups to larger enterprise teams and even media outlets.

- Technical depth: Very editorial by design. Their strength is in AI-assisted content creation and interview-led storytelling, NOT in the technical side of GEO (like structured data, retrieval optimization, or LLM crawlability).

- Editorial quality: Strong across the board. Their own content is thoughtful, clearly written, and genuinely helpful, which is exactly what you’d expect from an agency that puts content at the center of its work.

- Proof of results: Their case studies highlight impressive inbound growth and visibility wins. There’s a claim from the founder that one client saw a 40% increase in demo requests directly from generative engine exposure, but there isn’t yet a published case study showing how that result was achieved. So while their SEO and content-led performance is well documented, GEO-specific case study isn’t public yet.

- Fit: A great fit for brands that value strong thought leadership and want to scale visibility through AI-assisted editorial workflows. Less ideal for teams looking for deep technical GEO experimentation or end-to-end LLM infrastructure support.

Generate More approaches GEO from a writer’s lens rather than a developer’s one, and honestly, that’s refreshing. Their model is built around founder-led interviews that get turned into optimized, multi-format content pieces using their agentic AI models. It’s very smart and feels genuinely human-first in how it captures subject-matter expertise and turns it into visibility.

Where it feels weak is on the technical side because GEO, at its core, still depends on things like structured data, site architecture, and machine readability. And these are the areas where GenerateMore.AI doesn’t appear to go as deep.

So while their editorial engine is strong and their messaging around AI workflows is compelling, brands expecting a fully technical GEO program will might need to pair them with another partner.

5. Intero Digital

- Full-service scope: Operates as a broad digital agency with dozens of services across SEO, paid, PR, development, and creative. GEO is one piece of a much larger offering.

- Technical depth: Uses proprietary crawler tech (InteroBOT®) and their AI-powered GRO platform to guide GEO campaigns.

- Editorial quality: Framework includes entity-based content strategy, retrieval-friendly site structuring, digital PR, and technical SEO.

- Proof: Case studies cite major wins ($22M revenue growth for cloud software, 86% organic growth for sporting goods), but none are tied directly to GEO outcomes.

- Fit: Well-suited for large enterprises needing a one-stop shop, but GEO-specific expertise and SaaS-focused case studies remain thin.

Intero Digital has clearly put thought into GEO – they’ve built their own tools for it, which is more than most agencies are doing at this stage. Also, the way they talk about GEO, things like entity-based content and retrieval-friendly structuring, lines up well with how the space is evolving.

Where it falls short, at least for now, is in the proof. Their site is full of case studies, but the success stories tied specifically to GEO just aren’t there yet. Most of their big wins are around broader SEO or integrated campaigns for larger industries, healthcare, retail, cloud software, things like that.

That makes them a different fit.

If you’re a large enterprise looking for a partner who can handle everything under one roof, they’re a strong contender. But for smaller B2B SaaS teams in the $1–5M ARR range, they might feel a little too broad, with less GEO-specific experience to point to in the SaaS space.

6. Webspero

- Full-service scope: Covers everything from SaaS development to SEO, Shopify, blockchain, MVP builds, and marketing campaigns.

- Technical depth: No proprietary GEO tooling or processes made clear; their highlighted “GEO” work looks almost the same as work done for SEO.

- Editorial quality: Published wins show strong content-led growth, but largely for local and e-commerce brands, not SaaS.

- Proof: Case studies cite strong GEO results (training center, skin/hair brand, family-owned business in Texas) but lack a clear GEO methodology behind those numbers.

- Fit: Impressive overall portfolio, but not specialized for B2B SaaS, and no clear distinction between SEO vs GEO.

WebSpero is one of those agencies that really does it all; they’ll build your product, ship it, and then grow it through every marketing channel you can think of. On their GEO page, they’ve put forward some very strong results (for local training centers, a beauty brand, even a family-owned supplier business). The numbers look good, and we were initially impressed, so we wanted to see what their process was.

Once we checked the case studies, they read like standard SEO campaigns: solid technical fixes, content, link building, but nothing that shows a deeper, GEO-specific strategy. That doesn’t make the work any less valid (SEO is the backbone of GEO), but it does mean they haven’t shown how they differentiate between the two.

So while WebSpero clearly knows how to drive results in a wide range of industries, from local businesses to e-commerce, we didn’t see anything that convinced us they’re the right fit for B2B SaaS GEO (just yet).

7.WebFX

- Focus: Enterprise-scale, full-service agency with offerings across AI, development, UX, automation, and digital marketing.

- Technical Depth: Promotes proprietary tools like OmniSEO and Revenue Cloud FX, as data-powered platforms for search and GEO performance.

- Editorial Quality: Strong overall, they publish a steady stream of guides, industry updates, and resources that show authority.

- Proof of Results: GEO-specific proof is thin; headline numbers are shared but not tied to transparent case studies or client stories.

- Fit: Great for large enterprises with the budget for layered account management and tooling. Less suited for fast-moving B2B SaaS teams in the $1–5M ARR stage.

WebFX is massive – one of the biggest players in digital marketing. Their services cover everything from AI and automation to UX, content, and development. But when it comes to GEO specifically, they lean hard on their proprietary platforms like OmniSEO and Revenue Cloud FX, claiming billions of data points and big growth claims.

The challenge is that while those numbers sound impressive, they’re not tied to transparent GEO-specific case studies.

Instead, much of the emphasis is on their technology stack and account manager model.

For enterprise clients who want scale and structured programs, that model works. But for SaaS companies in the $1–5M ARR range, where agility, speed, and direct founder-to-founder touchpoints are very important, all this tech just creates layers that slow things down.

To their credit, their editorial output is solid. WebFX produces a lot of high-quality content, including guides, resources, and industry updates that reinforce their credibility. But in the GEO space, the work feels more like an extension of SEO than a dedicated, proven specialty.

For B2B SaaS founders looking for clarity and adaptability in GEO, WebFX feels too enterprise-heavy.

8. Go Fish Digital

- Focus: Broad coverage across industries including e-commerce, SaaS, legal, education, healthcare, and finance.

- Technical depth: Uses an AI-powered content evaluation platform called Barracuda that scores pages against multiple GEO-related factors.

- Editorial quality: Service page lays out a clear GEO process, showing structured thinking beyond just “we do GEO.”

- Proof: Strong client roster (HP, Mediclo) and SEO/marketing case studies, but no GEO-specific results shared publicly.

- Fit: Best suited for large, cross-industry enterprises. For $1–5M ARR SaaS brands, the breadth is impressive, but the lack of GEO-focused wins makes the fit less direct.

When we landed on Go Fish’s GEO page, we were really impressed because it’s rare to see an agency spell out their GEO process with that kind of structure. They even have a content evaluation tool of their own called the Barracuda tool. It scores content against multiple factors Google itself has laid out in different patents – makes a lot of sense for GEO.

That said, when we looked for proof, the gap was pretty clear. Their SEO and PR case studies are strong with big client names, but none of those wins are tied directly to GEO outcomes.

For SaaS companies in the $1–5M ARR range, we see that as a missing link, because this is the stage where proof of GEO traction really matters.

So while Go Fish has the tech, the talent, and a broad service range, we think they’re a better fit for bigger enterprises that want an all-in-one partner.

For smaller, fast-moving B2B SaaS teams, the dilution across industries and the absence of GEO-specific results make them feel less like the right partner right now.

9. mvpGrow

- Focus: Purpose-built for early – to growth-stage B2B SaaS companies that have an enterprise focus and want measurable, pipeline-level growth.

- Technical depth: Offer technical SEO, information architecture, and structured content, and claim to blend that with pragmatic GEO tactics aimed at Google’s AI Overviews and LLM answers. However, there’s no detailed breakdown or public documentation of how their GEO process actually works.

- Editorial quality: Strong overall. Their content is execution-focused (frameworks, guides and checklists) – the kind of material that’s clearly written by people who’ve been in the trenches with B2B SaaS founders.

- Proof of results: Claims mentions in AI overviews (Apono, Oktopost, and Jit), which point to some GEO success, but no detailed case studies have been published to show what drove those results. Their one available SEO case study breaks down inbound users, lead volume, and pipeline contribution impressively, but nothing GEO-specific yet.

- Fit: Best for early B2B SaaS startups that think big and want a growth partner who can manage the full spectrum – SEO, GEO, content, and campaign ops – under one roof. But teams looking for a test-heavy GEO partner deeply invested in AI-search visibility might find the focus a bit too traditional.

mvpGrow positions itself as a full-stack growth partner rather than just an SEO or GEO agency. They cover content production, campaign management, HubSpot ops, and even offer SDR-as-a-Service. This makes them appealing for founders who want a single partner to handle both strategy and execution without hiring multiple vendors.

Where it falls a little short is in the GEO depth. They’ve mentioned it as part of their offering, but there’s not much visible evidence of how they’re adapting to the new AI-search era. Unlike some of the newer GEO agencies that openly talk about evolving discovery models and AI-driven visibility, mvpGrow’s public-facing content still leans toward traditional marketing, sales-led, product-led, and demand-gen playbooks that work, but don’t yet reflect the full shift toward AI-driven search.

That said, they clearly understand SaaS growth mechanics and know how to turn strategy into measurable impact. If they start bringing that same clarity and proof to their GEO approach, they’ll be a serious contender among full-service growth agencies for B2B SaaS.

10. DEJAN.AI

- Focus: Positions itself as an AI-first marketing agency specializing in LLM visibility, with particular traction in medium-to-large e-commerce brands.

- Technical depth: Built around proprietary machine learning and NLP models that go “beyond traditional SEO”, using algorithms, data, and custom frameworks instead of the usual link-building and keyword play.

- Editorial quality: Framing suggests a sophisticated, data-driven approach, but no public-facing content or case studies to validate how that plays out in practice.

- Proof: Client list includes big names like Zendesk and Nickelodeon, yet no GEO-specific case studies or transparent results are available.

- Fit: Stands out as a leader in AI-driven methodology, but the lack of accessible proof makes it difficult to gauge fit for $1–5M ARR SaaS brands.

What stood out to us about Dejan.ai is how different their angle feels compared to most agencies we’ve looked at. They’ve built their whole pitch around algorithms, NLP, and custom evaluation frameworks. It’s a very tech-first way of approaching visibility, and in many ways, it overlaps with what GEO is meant to solve, even though they never call it GEO directly.

The catch is that while the positioning is impressive, there’s not much open proof to back it up. They highlight big-name clients, which builds some credibility, but you don’t see the step-by-step results or case studies that show how their models actually perform in practice.

For anyone, that gap makes it hard to connect the dots between the promise of the tech and the outcomes it can deliver.

How to choose the right GEO partner for your SaaS

When you’re picking a GEO partner, you’re betting that they can navigate an unpredictable, AI-driven search landscape and turn it into real growth for your business. That’s an important decision, so to make it a smart one, make sure they can check these boxes:

- Test-and-learn mindset: They work in sprints, have a clear hypothesis for every tactic, and adjust based on results instead of running the same playbook forever.

- Clear attribution: Wins are tied back to real pipeline movement, not just “citations went up.” They can connect the dots from AI visibility to revenue.

- Technical fluency: Comfortably talk (and show) work in entity optimization, schema, structured data, and digital PR that’s relevant to LLMs.

- Vertical alignment: Look for experience in YOUR stage and market. A SaaS GEO agency that mainly works with $200M+ enterprise brands will NOT be a fit for you when you’re in the $1M-$5M ARR range with completely different growth constraints.

- Proof you can verify: Case studies with named clients, real numbers, and context over vague “X% growth” slides.

- Balanced automation: AI tools are great, but editorial judgment, fact-checking, and accuracy still need a human in the loop.

Red flags to watch out for: guaranteed wins, obsession with vanity metrics (impressions, views, generic traffic spikes), or “fully automated” strategies with no clear editorial or QA process.

Pricing and scope: what to expect

Common Pricing Models

- Strategic Retainers: A fixed monthly fee that covers ongoing strategy, implementation, and testing. It’s good for teams who want a steady partner running experiments, iterating, and reporting back without having to constantly re-scope work.

- Project Sprints: Shorter, defined engagements (4–12 weeks) focused on a specific deliverable, like a GEO audit, entity optimization overhaul, or content refresh for priority topics.

- Tiered Packages: Pre-set bundles at different investment levels, usually with a cap on the number of deliverables or campaigns per month.

What drives cost:

- Scope: How much work is on the table (number of pages, content assets, PR campaigns).

- Velocity: How fast you need changes live and results coming in.

- Technical Depth: The complexity of your site setup and what’s needed to get it AI-ready.

- PR Needs: The scale of digital PR and authority-building required for your goals.

Scope Inclusions vs. Add-Ons

Inclusions vary, but the “core” of most GEO scopes often covers:

- Technical + content audits (with an AI-search lens).

- Entity optimization and schema markup improvements.

- Content restructuring to better match AI summarization patterns.

- Measurement setup and initial reporting cadence.

Add-ons (often billed separately) tend to include:

- Digital PR campaigns and authoritative mentions.

- Paid third-party list placements or partnerships.

- Advanced analytics dashboards or custom attribution setups.

- Training for internal teams.

RFP and vendor questions checklist

Ask these in your discovery calls or RFP process to see if their answers have depth, proof, and specifics that match your stage and goals.

Foundations & Approach

- How do you define GEO, and how is it different from SEO in your process?

- What steps do you take to ensure a strategy fits the B2B SaaS sales cycle (longer deal times, niche audiences, multiple decision-makers)?

- Can you walk me through the GEO tests you’re running right now and the biggest learnings from them?

- What are the top three mistakes you see SaaS brands make when trying to win AI search visibility?

Process & Timeline

- What will we see in month 1, month 3, and month 6 if we work together?

- How do you break down work between SEO fundamentals and GEO-specific tactics?

- How do you isolate GEO wins from SEO results so we know what’s driving impact?

Content & Citation Quality

- How do you ensure content is “citation-worthy” for AI systems?

- What’s your process for identifying and filling content gaps that LLMs care about?

- How do you approach link-building and mentions differently for GEO versus SEO? (They should mention Digital PR)

Measurement & Tooling

- What tools or methods do you use to measure AI visibility?

- Which top-of-funnel and bottom-of-funnel GEO KPIs do you track for SaaS brands?

- How do you connect AI visibility metrics back to pipeline and revenue?

Proof & Fit

- Can you share B2B SaaS case studies with named clients and specific results?

- How do you adjust strategies for companies in our ARR range?

- What does your test-and-learn cadence look like, and how often do you pivot based on results?

Red Flag Checks

- Do you offer any guarantees? (Correct answer: No.)

- Which vanity metrics do you ignore and why?

- How do you balance automation with editorial accuracy and human oversight?

Conclusion

Well, it’s clear that a lot of agencies are doing really solid work. Many of them have impressive SEO wins, and some are absolutely miles ahead of us in areas like e-commerce, local marketing, or big enterprise campaigns. But when it comes to GEO, for most of them, it still feels like an add-on, more of a new line item they’ve added to stay competitive than something they’ve truly mastered.

And that’s what’s different about Singularity. Because this is what we do every day, we’ve been able to test GEO-specific strategies, refine them, and actually deliver wins tied to SaaS growth.

Beyond campaigns, we often find ourselves sitting down with founders to talk through challenges that go past marketing, like growth bottlenecks, product decisions, and even hiring. That kind of one-on-one partnership is hard to replicate in bigger agencies. They’re great at what they do, but scale brings distance, and we like to stay close.

Book a FREE discovery call with us to discuss what GEO strategies your SaaS needs to build momentum and push past $1-$5M mark.

The Best GEO teams

Not all agencies are the same. We’ve found the ones who really understand SaaS and can help you get your content seen without all the guesswork.

FAQs about GEO

SEO helps you rank in traditional search results, GEO includes you in AI-generated answers.

SEO is still focused on optimizing for crawlers, rankings, and clicks. GEO is made for systems like Google’s AI Overviews or LLMs like ChatGPT, where the output is a synthesized response pulled from multiple sources.

For B2B SaaS, GEO services can start at around $2k/month. If you combine GEO + SEO into one package, starter pricing is closer to $5k/month, with costs scaling up depending on deliverables, speed, and PR investment.

P.S.: We offer discounted packages for clients who hire us for both GEO and SEO together.

While the field’s still evolving, these are the core GEO metrics that matter today:

– Inclusion Rate: How often your brand is mentioned in AI-generated answers for your target queries.

– Citation Frequency: How frequently AI assistants pull from your content or mention your brand by name.

– Prompt Coverage: The percentage of relevant prompts where your brand appears in the synthesized answer.

– AI-Assisted Conversions: Leads or sales influenced by AI search visibility, tracked through attribution modeling.